In today’s financial landscape, homeowners are continuously seeking efficient ways to leverage their most valuable asset—their home. One such method that offers flexibility, low costs, and various benefits, is a Home Equity Line of Credit (HELOC). Especially, when it comes to US Bank HELOC rates, homeowners may find an appealing avenue to finance major expenses such as home renovations, education, or consolidating high-interest debt. This article navigates through the ins and outs of HELOCs with a keen focus on what US Bank has to offer, ensuring homeowners are well-informed before making a decision.

Understanding HELOCs

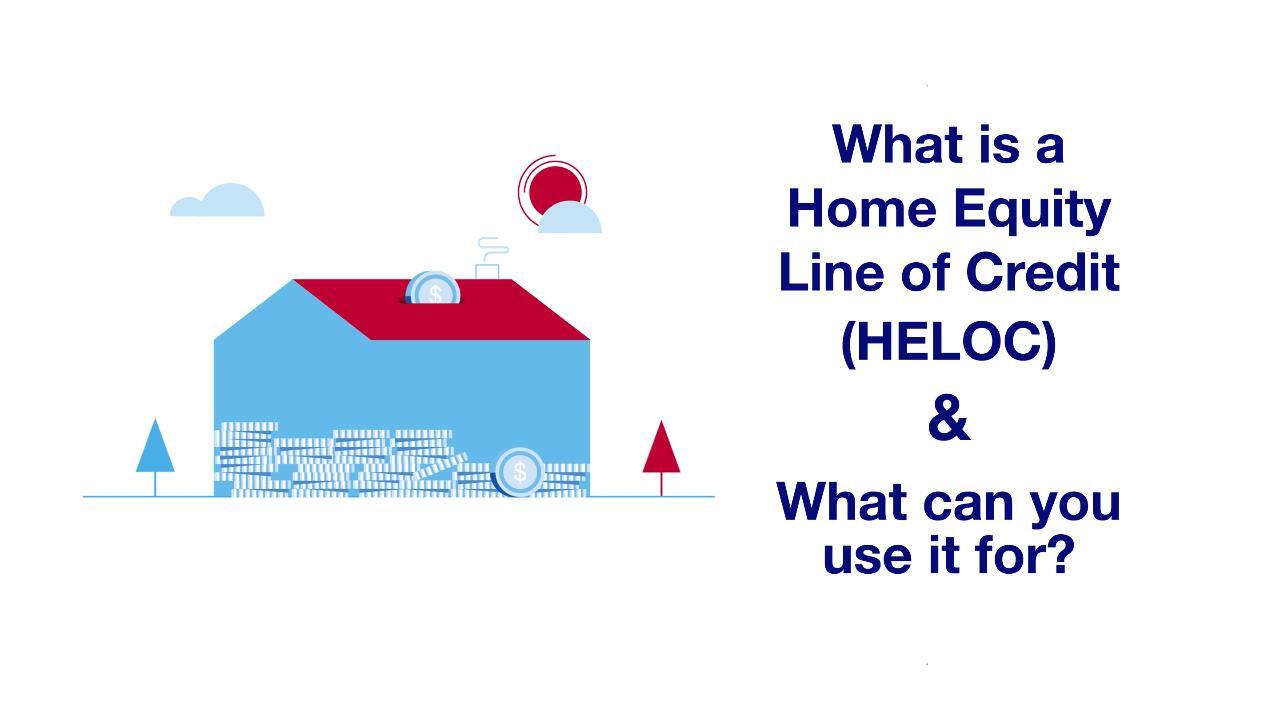

A HELOC resembles a credit card in that it provides a revolving line of credit, allowing homeowners to borrow against the equity in their home. The main attraction lies in its flexibility—you only pay interest on the amount you withdraw, up to the limit of the credit line. This financial tool typically comes with lower interest rates compared to other forms of borrowing, primarily because your home serves as collateral. As such, there is a lower risk for lenders. Moreover, the interest paid on HELOCs may also be tax-deductible.

There are two phases to a typical HELOC: the draw period and the repayment period. During the draw period (usually 5-10 years), you can withdraw funds up to your credit limit and make interest-only payments. Once this period ends, the repayment phase begins, where you must start repaying both principal and interest. The duration of the entire HELOC can span between 10-20 years, depending on the terms agreed upon.

US Bank HELOC Rates

As with any financial product, it’s crucial to compare different lenders before settling for one. In this regard, US Bank offers competitive HELOC rates, making it a top choice for homeowners. Currently, their APR (Annual Percentage Rate) ranges from 3.99% to 11.24%, depending on factors such as credit score and the loan-to-value ratio of your home. US Bank also offers a discounted rate for automatic payments from a US Bank personal checking account.

It’s worth noting that some HELOCs come with a fixed rate option, where you can lock in a certain interest rate for a specific period, providing predictability and stability to your payments.

Benefits of US Bank HELOC

Apart from the attractive rates, US Bank HELOCs come with several other benefits that make it a popular choice among homeowners. These include:

- No closing costs or application fees: US Bank does not charge any closing costs or application fees for their HELOCs, saving homeowners some upfront costs.

- No prepayment penalty: You can pay off your HELOC early without incurring any penalties, providing flexibility and control over your loan.

- Access to funds through various channels: US Bank offers online, phone, and branch access to your HELOC funds, making it convenient to withdraw money when needed.

- Interest-only payments during the draw period: As mentioned earlier, during the draw period, you only need to make interest payments, giving you some breathing room in your budget.

Is a US Bank HELOC right for you?

Before deciding on any financial product, it’s crucial to assess your financial situation and needs carefully. While a US Bank HELOC may offer numerous benefits, it may not be the best option for everyone. Some factors to keep in mind when considering a HELOC are:

- Your current and future financial goals

- Your credit score and income stability

- The value of your home and the loan-to-value ratio

- Potential changes in interest rates during the repayment period

How to Apply for a US Bank HELOC

Applying for a HELOC with US Bank is a straightforward process, but preparation is key to ensure a smooth experience. Here are the steps involved:

- Assess Your Financial Health: Before applying, examine your financial situation. This includes understanding your credit score, evaluating your home equity, and ensuring a stable income. These factors play a significant role in your application’s success and the rates you will be offered.

- Gather Necessary Documents: You’ll need to provide various documents during the HELOC application process. These typically include proof of income (such as W-2 forms or tax returns), statements of outstanding debts, a recent mortgage statement, and proof of homeowners insurance.

- Submit Your Application: You can apply for a HELOC with US Bank online, over the phone, or in-person at one of their branches. During this step, you’ll provide personal information, details about your home, and the required documents.

- Home Appraisal: US Bank may require an appraisal to determine your home’s current market value. This step is crucial as it impacts the amount of credit you can access.

- Underwriting: Once your application and appraisal are complete, it moves to underwriting. During this phase, all your information is reviewed, and your creditworthiness is assessed.

- Closing: If approved, you’ll move to the closing phase, where you’ll review and sign your HELOC agreement. Afterward, there’s usually a three-day rescission period, a right under federal law that allows you to cancel the agreement without penalty.

US Bank HELOC Offerings

US Bank distinguishes itself in the Home Equity Line of Credit (HELOC) market through its competitive rates and customer-oriented terms, setting a high standard for others in the industry. At present, US Bank offers an introductory rate that is particularly attractive for new borrowers, making the initial borrowing period highly beneficial in terms of financial cost. This period allows borrowers to enjoy lower interest rates before transitioning to a variable interest rate structure, which remains competitive and fair within the broader market context.

Features and Promotions:

Introductory Rates: To make its HELOC offerings even more enticing, US Bank frequently rolls out promotional rates. These promotions significantly reduce the interest cost for the initial months following the opening of the credit line, making it an ideal choice for those looking to leverage their home equity without facing steep initial costs.

Variable Interest Rates: After the conclusion of the introductory promotional period, US Bank transitions its borrowers to variable interest rates. These rates are meticulously calculated based on the current U.S. prime rate, ensuring that they remain both fair to the consumer and competitive when compared to other offerings in the market. This approach to interest rates underscores US Bank’s commitment to fairness and adaptability.

Flexibility: One of the hallmark features of a US Bank HELOC is its inherent flexibility. Applicants will find no application fee, adding to the product’s appeal by minimizing the financial burden often associated with securing a line of credit. Additionally, the absence of closing costs further reduces the upfront expenses, making a US Bank HELOC an even more attractive option for homeowners.

Eligibility and Application Process:

The process of securing a HELOC with US Bank is designed to be as straightforward as possible, yet it does necessitate meeting certain eligibility criteria to ensure that borrowers are in a secure

How US Bank Stands Against Competitors

When comparing HELOC rates and terms, US Bank consistently ranks as one of the most competitive choices. Its combination of low introductory rates, variable interest rates based on the prime rate, and customer-centric features like no closing costs, position US Bank favorably against other major banks. Some other noteworthy advantages of opting for a US Bank HELOC include:

- Multiple Channels for Accessing Funds: As mentioned earlier, US Bank provides multiple channels for accessing your HELOC funds, making it convenient and hassle-free.

- No Prepayment Penalties: You can pay off your HELOC early without incurring any penalties, providing flexibility and control over your loan.

- Ongoing Support: US Bank provides ongoing support for its HELOC products, with dedicated customer service teams to assist borrowers throughout their repayment period.

However, as with any financial product, it’s essential to consider all options and assess your personal financial situation before making a decision. It may also be beneficial to compare rates and terms with other lenders to ensure you are getting the best deal for your specific needs. Ultimately, the right HELOC for you will depend on various factors, including your credit score, home equity, and personal financial goals.

Making an Informed Decision

For homeowners contemplating the suitability of a Home Equity Line of Credit (HELOC), it’s crucial to take a structured approach in making this decision. Here are some detailed tips to guide you:

- Begin by thoroughly assessing your current financial situation and clearly defining the purpose of borrowing. Ask yourself whether you need the funds for home improvements, debt consolidation, or other significant expenses. Understanding your financial goals can help you decide if a HELOC is the right tool.

- Don’t settle for the first HELOC offer you come across. Make an effort to compare offerings from several banks and lending institutions. Pay special attention to the interest rates, fees (including any origination fees or annual charges), and the terms and conditions of the credit line. This comparison will help you find the most cost-effective option.

- Interest rates can fluctuate, so it’s important to consider how future changes might impact your monthly repayments and overall financial plan. A variable interest rate might seem appealing when rates are low, but consider your ability to meet your repayment obligations if rates rise.

- Lastly, consulting with a financial advisor or mortgage specialist can provide personalized insights. They can help analyze your financial health, forecast the potential impacts of taking out a HELOC on your finances, and determine the best option to meet your specific needs and financial goals.

By following these steps, homeowners can make a more informed decision about whether a HELOC fits into their financial strategy.

Real Stories from US Bank Customers

To provide a well-rounded view, here are some real stories from US Bank HELOC customers:

- “I was able to access the funds I needed for my home renovation project without facing significant upfront costs. The flexibility and competitive interest rates of US Bank’s HELOC made it the perfect fit for me.” – Sarah, homeowner in California

- “US Bank’s customer service was top-notch throughout my HELOC journey. They were always available to answer my questions and provided personalized support, making the process smooth and stress-free.” – John, homeowner in New York

- “Thanks to US Bank’s no closing costs policy, I didn’t have to worry about additional expenses when securing a HELOC. It made a significant difference for me as I was able to use the funds for debt consolidation and save on interest.” – Rachel, homeowner in Florida

As you can see from these stories, US Bank’s HELOC products have helped homeowners across the country achieve their financial goals. With its customer-centric approach and competitive offerings, it’s worth considering when exploring options for accessing credit against your home’s equity. So, take the time to research and compare various lenders before making a decision to find the best fit for your specific needs. And remember, a HELOC should be used responsibly and with careful consideration to avoid potential financial pitfalls in the future. So use it wisely and enjoy the benefits of tapping into your home equity!

Conclusion

A Home Equity Line of Credit (HELOC) can be a valuable financial tool for homeowners looking to leverage their home equity. US Bank offers competitive HELOC products with flexible terms, low introductory rates, and impressive customer support. However, it’s essential to make an informed decision by thoroughly assessing your financial situation and exploring options from other lenders before committing to a HELOC. Consulting with a financial advisor or mortgage specialist can also provide valuable insights and personalized recommendations. Remember, a HELOC should be used responsibly and with careful consideration to avoid potential financial difficulties in the future. So take the time to research and compare before applying for a HELOC and enjoy the benefits of accessing your home’s equity!