In the dynamic world of real estate investment, standing out among a sea of buyers can significantly impact your success. One of the most strategic steps you can take to not only differentiate yourself but also streamline your purchasing process is obtaining a Chase Mortgage Pre-Approval. This powerful tool offers a plethora of benefits, making it indispensable for real estate investors aiming to maximize their opportunities in a competitive market.

What is Mortgage Pre-Approval?

Mortgage Pre-Approval is a process where a lender, such as Chase, evaluates your financial information and credit history to determine the maximum amount they are willing to lend you for a home purchase. This evaluation provides you with an estimate of how much you can afford to spend on a property, empowering you with valuable knowledge and resources before even starting your property search.

Why is it Important for Real Estate Investors?

As a real estate investor, time is money. The faster you can secure financing, the quicker you can close deals and capitalize on opportunities. Mortgage Pre-Approval not only gives you an edge in terms of offering speed but also shows sellers that you are serious and ready to make a purchase.

Moreover, having a pre-approved mortgage amount helps you set a realistic budget and narrow down your property search. This saves you time, effort, and potential disappointment from falling in love with a property that is beyond your means.

Benefits of Chase Mortgage Pre-Approval

- Increased Credibility: With a pre-approved mortgage amount, sellers will take you seriously and view you as a qualified buyer. This can give you an advantage in negotiations and may even lead to a better deal.

- Faster Closing Process: Since your financial information has already been evaluated and approved, the closing process is likely to be quicker compared to traditional mortgages. This can help you secure desirable properties before other buyers have a chance.

- More Accurate Budgeting: Knowing exactly how much you can afford allows you to plan your budget more accurately. This includes factoring in important expenses such as property taxes, insurance, and maintenance costs.

- Flexible Financing Options: With Chase Mortgage Pre-Approval, you have access to a wide range of financing options that cater to different types of properties and investment strategies. This allows you to choose the best option for your specific needs and goals.

- Personalized Guidance: Chase offers personalized guidance throughout the pre-approval process, ensuring that you fully understand your financial capabilities and available options. This can help you make informed decisions and feel confident in your real estate investment journey.

In conclusion, obtaining a Chase Mortgage Pre-Approval can give you a significant advantage as a real estate investor. From increased credibility to flexible financing options, this tool can unlock your potential and lead you towards success in the competitive world of real estate investment. So don’t wait any longer, get started on your pre-approval process today and take the first step towards achieving your investment goals!

Additional Benefits of Chase Mortgage Pre-Approval

Aside from the benefits mentioned above, there are even more advantages to obtaining a Chase Mortgage Pre-Approval. Here are a few additional benefits to consider:

- Avoid Delays and Rejections: By going through the pre-approval process, any potential issues with your credit or financial information can be identified and addressed beforehand. This helps you avoid delays or rejections that could result in missing out on a desirable property.

- Better Negotiation Power: With a pre-approved mortgage, you have a clear understanding of your budget and can confidently negotiate with sellers. This puts you in a stronger position to secure the best deal possible.

- Competitive Interest Rates: Since Chase offers personalized guidance throughout the pre-approval process, they can help you understand the current interest rates and choose the most competitive option for your investment goals.

- Streamlined Application Process: Once you have obtained a Chase Mortgage Pre-Approval, the application process for a specific property becomes much smoother and quicker. This is because most of your financial information has already been evaluated and approved.

- Minimal Impact on Credit Score: Unlike applying for multiple mortgages with different lenders, obtaining a single pre-approval from Chase will only result in one credit check. This minimizes the impact on your credit score and helps maintain a healthy financial profile.

Overall, Chase Mortgage Pre-Approval offers numerous benefits that can greatly benefit real estate investors. From saving time and effort to providing personalized guidance and flexibility, it is a valuable tool that should not be overlooked. Take advantage of this opportunity and unlock your full potential in the competitive world of real estate investment with Chase Mortgage Pre-Approval.

About ChaseMortgage pre-approval

Chase Mortgage Pre-Approval stands as a testament to Chase’s commitment to aiding real estate investors in navigating the complexities of the property market with ease and confidence. Their approach emphasizes not only financial readiness but also a strategic foresight into the real estate investment process. This blend of financial acumen and market insight equips investors with the tools necessary to make educated decisions, seize opportunities quickly, and negotiate deals with confidence.

Pre-Qualification vs. Pre-Approval with Chase

You can get pre-approved for a mortgage through Chase Bank! Here’s how the process works.

It’s important to understand that Chase offers pre-qualification and pre-approval, which are slightly different stages:

- Pre-qualification: This is a starting point to get a rough estimate of how much you might be able to borrow based on a quick review of your self-reported financial information. It’s a faster process but less reliable than a pre-approval.

- Pre-Approval: This is a more thorough assessment where Chase verifies your documents and credit report to provide a more accurate idea of your borrowing power. It involves a harder credit check but strengthens your position as a buyer.

Chase Mortgage Pre-Approval Process

Chase doesn’t currently offer online pre-approval for mortgages. Here’s how to initiate the pre-approval process:

- Contact a Chase Mortgage Specialist: Begin by locating a qualified mortgage specialist near you, which can be done easily through Chase Bank’s official website or by directly contacting their dedicated mortgage lending department via phone. This is the first step in starting your journey toward homeownership with Chase.

- Discuss Your Needs: Once you’ve connected with a mortgage specialist, take the opportunity to have a detailed conversation about your specific home buying objectives. Whether you’re looking for a fixed-rate mortgage that offers stability in your monthly payments or an adjustable-rate mortgage that may provide lower initial rates, your specialist can help. Don’t forget to discuss your down payment preferences and explore the various options available to you.

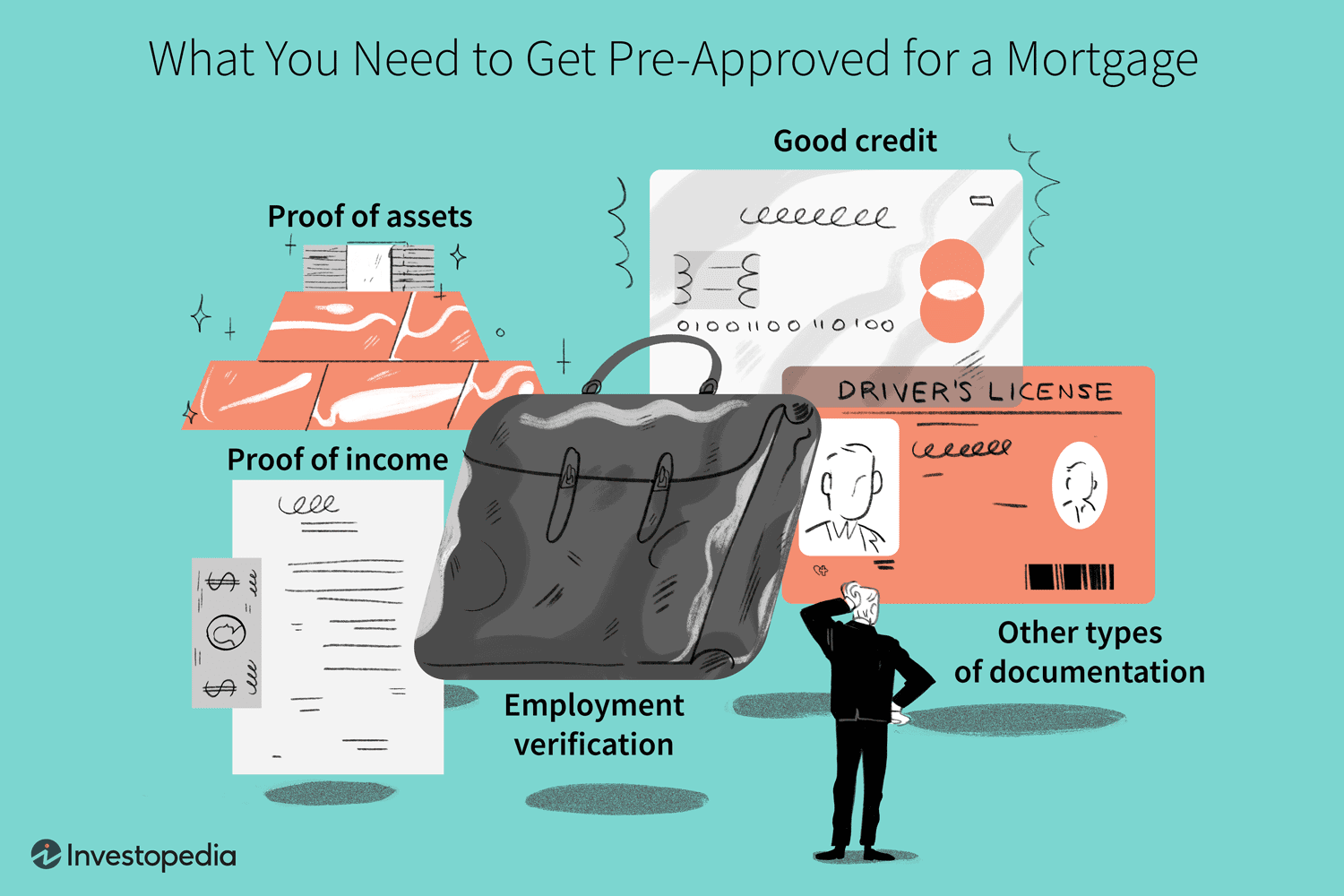

- Gather Your Documents: To move forward, you’ll need to provide comprehensive documentation that verifies your financial situation. This includes, but is not limited to, recent pay stubs and tax returns to confirm your income, bank statements to verify your assets, and any relevant information regarding your current debts. Being thorough and prepared at this stage will streamline the process.

- Credit Check: With your agreement, the mortgage specialist will perform a thorough credit check. This hard inquiry is a standard part of the mortgage application process and will give Chase a clear picture of your creditworthiness, which is crucial in determining the terms of your loan.

- Pre-Approval Letter: After the credit check and document review, if you meet Chase’s lending criteria, they will issue a pre-approval letter. This important document will detail the estimated loan amount you qualify for, the interest rate you can expect, and the preliminary terms of the loan. Having this letter not only gives you a clear idea of what you can afford but also strengthens your position as a serious buyer when you’re ready to make an offer on a home.

Benefits of Pre-Approval with Chase

- Know Your Budget Precisely: Getting pre-approved by Chase gives you a clear understanding of how much money you’re eligible to borrow. This crucial insight allows you to tailor your home search towards properties that are within your financial reach, ensuring you don’t waste time on homes outside your budget.

- Submit Stronger Offers: Having a pre-approval letter in hand when you make an offer on a home significantly strengthens your position. It demonstrates to sellers that you’re a committed buyer with the backing of a reputable lender like Chase, making your offer more appealing compared to those from buyers who aren’t pre-approved.

- Enjoy a Streamlined Mortgage Process: One of the biggest advantages of pre-approval is how it streamlines the subsequent steps in your home-buying journey. With the majority of your financial information already verified by Chase, moving forward to final loan approval is smoother and can be expedited, getting you closer to owning your dream home.

Additional Tips for a Better Mortgage Experience

- Comparison Shop: Although choosing Chase for your mortgage needs might seem like the easiest option, it’s wise to shop around. By comparing rates, fees, and terms from various lenders, you ensure that you secure the best mortgage deal available, saving you money in the long run.

- Boost Your Credit Score: Before applying for pre-approval, take steps to improve your credit score. A higher score not only increases your chances of approval but can also land you a lower interest rate. This can translate into significant savings over the life of your mortgage.

- Be Fully Transparent: During the pre-approval process with Chase, it’s vital to provide complete and accurate financial information. Any discrepancies can lead to delays or even jeopardize your pre-approval status. Transparency ensures a smoother process and helps avoid any unexpected hurdles.

By adhering to these guidelines and leveraging the benefits of pre-approval with Chase, you’ll be well on your way to acquiring the financing you need for your new home, armed with knowledge and a solid plan to navigate the home-buying process.

By getting pre-approved with Chase, you can gain valuable insight into your borrowing power and strengthen your position as a competitive home buyer. Remember to compare rates and explore all options before making a final decision.

Streamlining the Home Buying Process

The initial advantage of a Chase Mortgage Pre-Approval is its ability to outline a clear budget for your investment endeavors. Understanding exactly how much you can afford before you start your property search enables you to focus on listings that align with your financial parameters, thereby optimizing your search efficiency. This clarity not only saves time but also prevents the disappointment of setting your heart on properties out of reach.

Chase Mortgage Pre-Approval with Real estate investors

For real estate investors, a Chase Mortgage Pre-Approval can be an invaluable tool in the acquisition process. The financial assurance it provides helps in making swift decisions when a suitable property comes to market, a critical advantage in competitive real estate environments. Investors can leverage their pre-approved status to negotiate better terms and potentially close deals faster, which is essential for capitalizing on opportunities with a narrow window of availability. Additionally, understanding the financial parameters defined by the pre-approval allows investors to more accurately calculate their return on investment, ensuring their purchases align with long-term strategic goals. By systematically preparing and utilizing a Chase Mortgage Pre-Approval, real estate investors position themselves as serious, capable participants in the property market, ready to act when the right opportunity presents itself.

Gaining a Competitive Edge

In hot real estate markets, where multiple offers on a single property are the norm, being able to move quickly and decisively is vital. A Chase Mortgage Pre-Approval letter in hand demonstrates to sellers that you are not just a serious buyer but also one prepared to close the deal swiftly. This assurance can be just the advantage you need to stand out from other potential buyers who may still be navigating their financing options.

Efficient House Hunting

With a Chase Mortgage Pre-Approval, you’re given the liberty to tailor your property search to align with your pre-approved mortgage amount. This laser-focused approach allows you to efficiently sift through listings, dedicating your time and efforts to viable investment opportunities. It streamlines the entire discovery process, enabling you to act fast on promising ventures.

Speeding Up the Final Loan Approval Process

While the pre-approval itself is an initial step in the mortgage process, it significantly accelerates the final stages once you’ve selected a property. Given that Chase has already assessed your financial health and creditworthiness, moving forward towards the final loan approval becomes smoother and quicker. This expedited process is invaluable for investors looking to seize opportunities without delay.

Demonstrating Serious Intent

The real estate market thrives on certainty and the demonstration of serious intent can be the key to winning over sellers. A Chase Mortgage Pre-Approval does exactly that by signaling to all parties involved that you are not merely browsing but are ready and able to make a purchase. This can make all the difference in negotiations, potentially leading to more favorable terms or the acceptance of your offer over others.

In conclusion, a Chase Mortgage Pre-Approval offers numerous benefits, from streamlining the home-buying process to giving you a competitive edge in the real estate market. By following some additional tips and leveraging this powerful tool, you can have a smoother, more efficient, and ultimately more successful mortgage experience with Chase.

Conclusion

For real estate investors, a Chase Mortgage Pre-Approval is not just a step in the mortgage process; it’s a strategic investment tool. It streamlines your property search, provides a competitive edge in negotiations, and demonstrates your commitment to securing the deal. In a market where timing and preparation are everything, having your mortgage pre-approval aligned with an institution like Chase can propel your real estate investment career forward. Start your investment journey on the right foot—consider securing a Chase Mortgage Pre-Approval today.

Whether you’re eyeing your first investment property or looking to expand your portfolio, understanding the benefits and leveraging the power of Chase Mortgage Pre-Approval can significantly enhance your buying experience. Remember, in the world of real estate investment, being well-prepared is half the battle won.