In today’s dynamic world, the quest for a personal loan that caters to all your needs without the burden of exorbitant fees or stringent terms leads many online borrowers directly to the doorstep of one notable lender: SoFi. Renowned for merging competitive interest rates with a spectrum of borrower-friendly benefits, a SoFi personal loan stands out as a beacon of flexibility and value. Whether you’re looking to consolidate debt, make home improvements, or finance a significant purchase, here’s why a SoFi personal loan could be your optimum financial ally.

What is SoFi personal Loans?

SoFi Personal Loans stands out as a strong contender in the personal loan market, particularly for those looking to consolidate debt. To provide a more comprehensive understanding of SoFi Personal Loans and assist you in determining if it’s the ideal choice for your financial needs, let’s delve deeper into its features:

SoFi personal Loans Pros

- Competitive Interest Rates: SoFi is renowned for offering some of the most competitive interest rates in the personal loan industry. This can be a substantial benefit, particularly for those seeking larger loan amounts or borrowers who have maintained a good credit history. Lower interest rates mean you could potentially save thousands of dollars over the life of your loan.

- No Origination Fees: One of the standout features of a SoFi personal loan is the absence of origination fees. Many lenders charge these upfront fees for processing your loan application or upon approval, which can add to the overall cost of your loan. With SoFi, this is not a concern, allowing you to save money right from the start.

- Unemployment Protection Option: In today’s unpredictable job market, SoFi’s unemployment protection offering is a significant advantage. Should you find yourself facing involuntary job loss, SoFi allows for a pause in your loan payments for a predetermined period. This unique feature provides a layer of financial security during challenging times, giving you one less thing to worry about.

- Wide Range of Loan Amounts: Whether you’re looking to consolidate a small amount of debt or finance a large project, SoFi’s wide range of loan amounts, from $5,000 to $100,000, makes it a versatile option for numerous financial situations. This flexibility can be especially useful for borrowers with larger financing needs, such as home renovation projects or consolidating significant debt.

SoFi personal Loans Cons

- Soft Credit Check for Pre-qualification, Hard Check for Approval: SoFi’s initial soft credit check for pre-qualification is a great way to explore your eligibility without impacting your credit score. However, it’s important to note that proceeding beyond pre-qualification requires a hard credit check, which can slightly lower your credit score. This is a standard practice but something to be aware of if you are considering applying.

- May Not Be the Best for Fair or Bad Credit: While SoFi Personal Loans offer numerous advantages, they are generally best suited for borrowers with good to excellent credit scores. If your credit is fair or poor, you might still qualify for a loan with SoFi, but the terms may not be as favorable. Alternatively, you may need to look towards lenders who specialize in catering to borrowers with lower credit scores, although this often means facing higher interest rates.

In conclusion, SoFi Personal Loans provide a compelling option for borrowers with good credit looking to consolidate debt, fund significant projects, or require flexible loan terms without the burden of origination fees. With competitive rates, comprehensive loan amounts, and unique features like unemployment protection, SoFi deserves consideration in your search for the right personal loan. However, as with any financial decision, it’s important to carefully evaluate your own financial situation and consider all options before proceeding.

SoFi Personal Loans compare to other lenders

- LightStream: Potentially lower interest rates for borrowers with excellent credit, but SoFi offers unemployment protection and caters to a wider range of credit scores.

- Upgrade: A better option for borrowers with fair credit, but SoFi might offer lower interest rates for those with good or excellent credit.

- Discover Personal Loans: Similar features to SoFi in terms of pre-qualification and no origination fees, but SoFi might have a wider loan amount range and potentially lower rates for certain credit tiers.

- Marcus by Goldman Sachs: Geared more towards borrowers with excellent credit, while SoFi offers unemployment protection and caters to a wider credit score range.

Is SoFi Personal Loan Right for You?

SoFi Personal Loans can be an excellent option for borrowers under certain conditions:

- If you have good or excellent credit scores and are looking for a competitive interest rate on your personal loan, SoFi might be the right lender for you. Their rates are designed to be attractive for borrowers with strong credit histories, reflecting the lower risk they pose.

- You might also consider SoFi if you require a larger loan amount for purposes such as debt consolidation, home improvements, or other significant expenses. SoFi is known for offering substantial loan amounts, which can be incredibly helpful for those needing to consolidate high-interest debt or fund large projects.

- Additionally, SoFi’s unemployment protection feature is a unique benefit that provides a safety net in the event of job loss. This feature allows for temporary suspension of loan payments while you search for a new job, offering peace of mind and financial security.

Things to consider before

- Compare Rates: While SoFi is known for their competitive rates, it’s crucial to shop around and compare rates from various lenders. This ensures that you secure the lowest possible interest rate, potentially saving you a significant amount of money over the life of your loan.

- Consider Your Credit Score: SoFi predominantly serves borrowers with good to excellent credit scores. Their competitive rates and terms are more accessible to those with stronger credit. If your credit score falls into the fair or poor category, it might be beneficial to look into lenders that specialize in catering to those with less-than-perfect credit.

- Evaluate Your Needs: SoFi provides a broad range of loan amounts, but it’s important to assess how much money you truly need. Borrow only what is necessary to meet your goals, keeping in mind your ability to repay the loan comfortably. This approach will help you avoid overborrowing and ensure that your loan serves as a financial tool rather than a financial burden.

By meticulously evaluating these aspects, you can make a well-informed decision about whether a SoFi personal loan is the right choice for your financial situation and borrowing needs.

Advantages of SoFi personal Loans

Among the standout advantages of choosing a SoFi personal loan is the option for co-signers. This feature is particularly beneficial for borrowers who may not have a strong credit history or high income on their own but can apply with someone who does.

Competitive Interest Rates: A Path to Significant Savings

One of the critical considerations when selecting a personal loan is the interest rate. SoFi shines in this aspect by offering rates that are not only competitive but are designed to reward borrowers. These attractive rates equate to lower monthly payments and substantial savings over the life of your loan, setting SoFi apart in a crowded market. This feature is particularly appealing for online borrowers who are savvy in comparing rates and seeking the best economic terms. Additionally, SoFi’s focus on increasing financial literacy through their community platform and educational resources can help borrowers understand the significance of competitive rates in achieving long-term financial goals.

Transparent and Flexible Borrowing Terms

Transparency in lending is more than a buzzword with SoFi personal loans; it’s a foundational principle. Borrowers will find no origination fees or hidden charges lurking in the fine print. Additionally, the absence of prepayment penalties means that you can repay your loan ahead of schedule without incurring extra costs, providing a level of flexibility that resonates with those who value financial freedom.

The Ease of a Fast and Simple Online Application Process

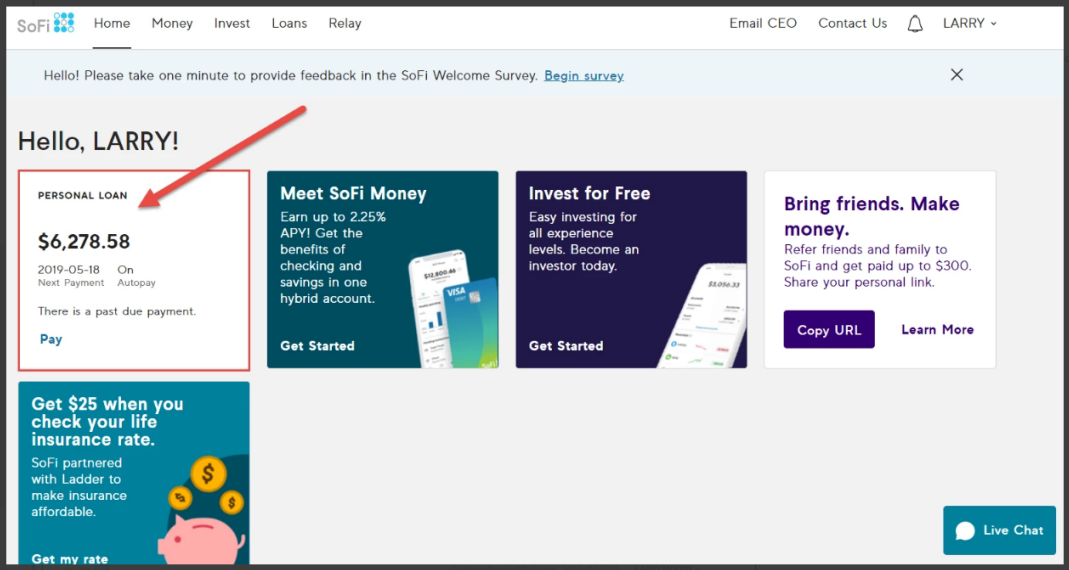

In an era where time is of the essence, the fast and simple online application process of a SoFi personal loan is a breath of fresh air. From the comfort of your home, you can initiate the application process, submit necessary documentation, and receive a decision in record time. This streamlined approach minimizes stress and maximizes efficiency, allowing borrowers to focus on what matters most—realizing their financial goals.

High Loan Limits for Your Varied Needs

Whether it’s undertaking a major home renovation project, consolidating high-interest debt, or funding a once-in-a-lifetime event, SoFi’s high loan limits cater to a broad spectrum of borrowing needs. With the ability to secure the funds necessary to achieve your objectives, SoFi personal loans empower borrowers to dream big and reach high.

Exclusive Access to Member Benefits

Taking out a SoFi personal loan opens the door to more than just financial capital; it grants access to an exclusive suite of member benefits designed to support your overall financial well-being. These perks include career coaching, unemployment protection, and personalized financial planning. Each benefit is curated to enhance the borrower’s life, providing a holistic approach to personal finance that extends well beyond the loan itself.

Customer Reviews and Experiences with SoFi Personal Loans

Customer reviews and experiences with SoFi personal loans often highlight the ease and efficiency of the application process, as well as the high level of customer service provided by the lender. Many borrowers appreciate the transparency and the absence of hidden fees, which sets SoFi apart from many other lenders in the market. Positive testimonials frequently mention the competitive interest rates and how these rates have facilitated borrowers in achieving their financial goals without overburdening them with excessive costs.

Additionally, the comprehensive support offered through member benefits like career coaching and financial planning is frequently cited as a significant value add that enriches the borrowing experience. This combination of financial and professional support services underlines SoFi’s commitment to not just being a lender, but a partner in their members’ financial journeys. However, it’s important for potential borrowers to consider their individual financial situations and compare offerings from different lenders to ensure that a SoFi personal loan is the best choice for their specific needs and circumstances.

In Conclusion

Choosing a SoFi personal loan offers a blend of financial efficiency, flexibility, and a suite of benefits tailored to the modern borrower’s needs. With competitive interest rates, a hassle-free application process, and a range of exclusive perks, SoFi stands as a leading choice for online borrowers seeking to optimize their financial resources. Whether you’re consolidating debt, financing a significant expense, or simply seeking a reliable lending partner, a SoFi personal loan could be the key to unlocking your financial potential. Explore your options today and take a significant step towards achieving your financial goals with SoFi.