In today’s fluctuating economic landscape, refinancing your mortgage can be a smart move to lower your monthly payments, tap into your home’s equity, or save money over the life of your loan. With a plethora of lenders vying for your attention, it’s crucial to choose one that not only offers competitive rates but also enhances your refinancing experience with ease and support. Enter Ally Home Loans, a beacon for refinancers seeking to maximize their financial wellbeing without the typical hassle involved in securing a new mortgage.

What is ally home loans?

Ally Home Loans is a division of Ally Bank, a leading online-only bank that provides customers with a variety of financial services. As part of their offerings, they provide mortgage refinancing options to help homeowners achieve their financial goals and improve their overall financial health. Whether you’re looking to lower your monthly payments, shorten the term of your loan, or use your home equity for other purposes, Ally Home Loans has you covered with their streamlined refinancing process and competitive rates.

Why choose ally home loans for refinancing?

- Competitive rates: As a leading online lender, Ally Home Loans offers some of the most competitive rates in the industry. This means you can potentially save thousands of dollars over the life of your loan compared to traditional brick-and-mortar lenders.

- Superior customer service: Ally Home Loans prides itself on providing exceptional customer service to their clients. Their dedicated team of mortgage experts is available to guide you through the refinancing process and answer any questions you may have along the way.

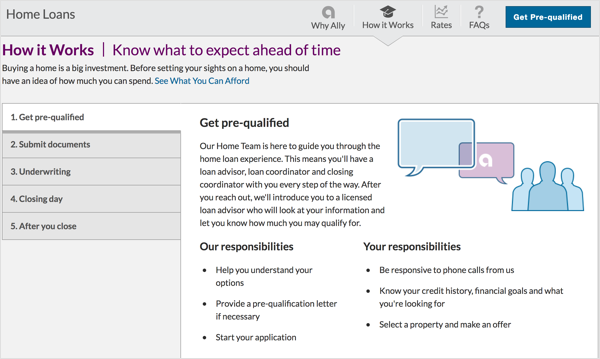

- Streamlined refinancing process: Refinancing with Ally Home Loans is a hassle-free experience. With their user-friendly online application and digital document submission, you can complete the entire process from the comfort of your own home.

- Transparency: Ally Home Loans believes in transparency and provides borrowers with all the necessary information upfront. This includes a comprehensive breakdown of fees and costs associated with refinancing, so you know exactly what to expect.

- Variety of loan options: Whether you have a conventional, FHA, or VA loan, Ally Home Loans offers refinancing options for a variety of loan types. This gives you the flexibility to choose the best option that suits your financial needs and goals.

How to get started with ally home loans refinancing?

Getting started with refinancing through Ally Home Loans is simple and straightforward. Here are the steps to follow:

- Visit the Ally Home Loans website and explore their refinancing options. https://www.ally.com/home-loans/mortgage/

- Use their online refinance calculator to estimate your potential savings.

- Complete the online application and submit any necessary documents electronically.

- Work with a dedicated mortgage expert from Ally Home Loans to finalize your loan terms and lock in your rate.

- Close on your new loan and start enjoying the benefits of refinancing with Ally Home Loans.

In conclusion, refinancing with Ally Home Loans can provide you with numerous benefits, including lower monthly payments, increased equity in your home, and potential savings over the life of your loan.

Refinancing made easy with Ally Home Loans

Are you considering refinancing your mortgage, but feeling overwhelmed by the process? Look no further than Ally Home Loans. With their streamlined process, competitive rates, and exceptional customer service, refinancing with Ally Home Loans has never been easier. Here are some reasons why refinancing with Ally Home Loans should be your top choice:

- Competitive rates: With their online-only model, Ally Home Loans is able to offer some of the most competitive rates in the industry. This means potential savings for you over the life of your loan.

- User-friendly experience: Say goodbye to tedious paperwork and in-person appointments. Ally Home Loans offers a user-friendly online application and digital document submission, making the refinancing process quick and easy.

- Personalized support: Have questions or need assistance? Ally Home Loans has a team of dedicated mortgage experts ready to guide you through the refinancing process and provide personalized support along the way.

- Transparent fees: No hidden fees or surprises here. Ally Home Loans believes in transparency and provides borrowers with a breakdown of all fees and costs associated with refinancing upfront.

- Variety of loan options: Whether you have a conventional, FHA, or VA loan, Ally Home Loans offers refinancing options for a variety of loan types. This gives you the flexibility to choose the best option for your financial needs and goals.

Benefits of Ally Home Loans

Refinancing with Ally Home Loans is not just about saving money and getting better rates. It’s also about taking control of your

Competitive Interest Rates That Work in Your Favor

Ally Home Loans stands out in the crowded marketplace with its attractive interest rates for refinancing. Whether you’re looking to lower your monthly payments, change your loan’s term, or switch from an adjustable-rate to a fixed-rate mortgage, Ally provides competitive rates that could save you money—both now and in the long run. This is especially pivotal for homeowners who are looking to make the most out of their investment and ensure their finances are as streamlined as possible. By working with Ally Home Loans, you not only gain lower rates but also build equity in your home and improve your overall financial wellbeing. # Make the most out of your investment with Ally Home Loans refinancing

In addition to competitive interest rates, Ally Home Loans also offers a variety of loan options to suit different needs and preferences. Whether you have a conventional, FHA, or VA loan, Ally Home Loans has a refinancing option for you. This flexibility allows you to choose the best solution for your unique financial situation and goals.

With their focus on transparency, user-friendly experience, and personalized support, Ally Home Loans is changing the game in the refinancing industry. Say goodbye to confusing paperwork, hidden fees, and long wait times. Say hello to a stress-free and efficient refinancing process with Ally Home Loans. Don’t miss out on the opportunity to improve your financial situation and unlock your potential. Choose Ally Home Loans for your refinancing needs today.

A Streamlined Online Application Process

Gone are the days of endless paperwork and opaque lending processes. Ally Home Loans revolutionizes the refinancing experience with its streamlined online application process, making it convenient and efficient for busy borrowers. Their user-friendly platform guides you through each step, demystifying the complexities of refinancing. This digital-first approach means you can manage your application on your schedule, making the path to refinancing harmonious with your bustling life.

Personalized Support from Mortgage Experts

While the convenience of an online application is undeniable, having expert guidance can make a world of difference. Ally Home Loans ensures that borrowers are not left navigating the refinancing waters alone. Their team of dedicated mortgage experts is ready to offer personalized support, ensuring you understand your options fully and can make informed decisions. This blend of digital efficiency and human touch provides a reassuring presence, making Ally Home Loans a partner in the truest sense during the refinancing process.

A Variety of Loan Products to Meet Your Needs

Refinancing is not a one-size-fits-all scenario; different financial goals require different mortgage solutions. Ally Home Loans caters to a broad spectrum of borrower needs with its diverse range of loan products, including fixed-rate, adjustable-rate, and jumbo loans. Whether you’re aiming for the predictability of fixed payments or the initial low payments of an adjustable-rate mortgage, Ally has options tailored to meet your financial circumstances and goals.

Transparent Terms and Fees

Transparency is the cornerstone of trust, especially when it comes to financial services. Ally Home Loans commits to transparency in all its dealings, ensuring that there are no hidden costs to catch you off-guard. Their straightforward approach lets you see the exact terms and fees associated with your refinancing loan, providing peace of mind and allowing you to plan your finances with confidence.

Debunking Common Refinancing Misconceptions

Despite the numerous benefits of refinancing, there are still some misconceptions that hold people back from exploring this option. Let’s debunk some of the common myths surrounding refinancing:

- Myth: Refinancing is only for those in financial trouble.

Fact: On the contrary, refinancing can actually help improve your financial situation by reducing interest rates and lowering monthly payments.

- Myth: Refinancing is too complicated and time-consuming.

Fact: With the advancements in technology, refinancing has become much more streamlined and efficient. Ally Home Loans’ online application process makes it convenient and hassle-free.

- Myth: It’s not worth refinancing if you’re planning to move soon.

Fact: Depending on your specific situation, refinancing can still be beneficial even if you plan on moving in the near future. It’s best to consult with a mortgage expert to determine if it’s the right decision for you.

- Myth: You need perfect credit to refinance.

Fact: While having good credit certainly helps, there are options available for those with less than perfect credit. It’s worth exploring your options and speaking with a mortgage expert to see what is possible for you.

Hear from Our Happy Homeowners

At Ally Home Loans, we’re proud of the positive impact we’ve made on our customers’ lives. But don’t just take our word for it—here are some of the testimonials from homeowners who have experienced the Ally Home Loans difference:

“Refinancing with Ally was a breeze!”

“I was dreading the refinancing process, but Ally Home Loans made it so easy. Their online application was straightforward, and their team was there to help me every step of the way. I managed to secure a much lower interest rate, which has made a significant difference in my monthly budget. I couldn’t be happier with the decision to go with Ally.”

—Samantha R., Atlanta, GA

“Ally saved me from financial stress!”

“With the economic uncertainties, I was really feeling the pinch with my old mortgage terms. Refinancing with Ally Home Loans lifted a huge burden off my shoulders. The expert advice I received made me feel supported and understood. Plus, the transparent fees meant I knew exactly what I was getting into. Highly recommend Ally for anyone looking to refinance.”

—Mark T., Denver, CO

“Best decision for my family’s future.”

“Choosing Ally Home Loans for our refinancing needs was the best decision we could have made for our family’s financial future. The lower interest rates and flexible loan options allowed us to reduce our monthly payments substantially. Now, we’re more secure in our finances and can start saving for our children’s education. Thank you, Ally!”

—Jennifer A., Sacramento, CA

These stories are just a small glimpse into the myriad of ways Ally Home Loans is helping homeowners across the country achieve their financial goals through refinancing. Each testimonial underscores our commitment to providing a seamless and supportive refinancing experience that meets our customers’ unique needs.

Conclusion

For homeowners considering the refinancing route, Ally Home Loans presents a compelling package of benefits that cater to modern borrowers’ needs. Their combination of competitive interest rates, a streamlined online process, expert guidance, a variety of loan options, and transparent terms makes them a standout choice. If saving money, convenience, and getting personalized support are on your refinancing checklist, Ally Home Loans might just be the partner you’re looking for to achieve your financial goals.

In the dynamic world of home financing, making the right choice can have a lasting impact on your financial wellbeing. Ally Home Loans invites refinancers to explore how their offerings can align with your objectives, empowering you to make decisions that will resonate positively with your future.