For military veterans and active duty personnel considering refinancing their home, choosing the right lender is pivotal. The benefits of finding the best VA refinance lenders are numerous, offering not just potentially lower interest rates but also a process tailored to the unique needs of those who have served our country. This article aims to guide you through the essential benefits of selecting top-tier VA refinance lenders and how doing so can positively impact your financial future.

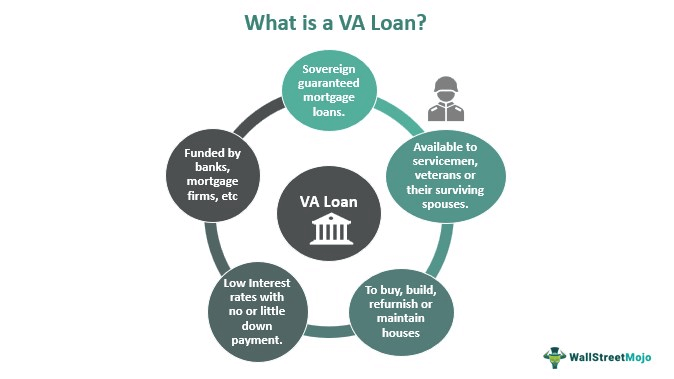

What is VA Refinance?

Before diving into the reasons for seeking out top VA refinance lenders, it’s important to understand what a VA refinance is and how it differs from other types of refinancing. A VA refinance, also known as an Interest Rate Reduction Refinancing Loan (IRRRL), allows eligible military personnel and veterans to replace their current mortgage with a new one at a lower interest rate. This can result in lower monthly mortgage payments, saving homeowners money in the long run.

Benefits of Choosing the Best VA Refinance Lenders

Now that we understand what a VA refinance is, let’s explore why selecting the best lender for this type of loan is crucial. Here are some key benefits to keep in mind:

Understanding of Military and Veteran Needs

One of the most significant advantages of choosing top VA refinance lenders is their deep understanding of the unique needs and challenges faced by military personnel and veterans. These lenders are well-versed in the intricacies of VA loans and can guide borrowers through the process with expertise and care.

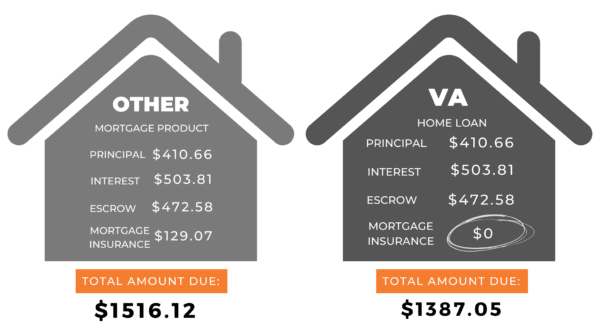

Competitive Interest Rates

As with any loan, interest rates play a crucial role in determining its overall cost. Top VA refinance lenders often offer competitive rates, which can result in significant savings for borrowers. Additionally, these lenders may also have special programs or offers specifically designed for military personnel and veterans.

Streamlined Process

Top VA refinance lenders are well-equipped to handle the specific requirements and paperwork involved in refinancing a VA loan. This means that the process is often streamlined and efficient, resulting in a faster closing time and less stress for borrowers.

Excellent Customer Service

Veterans and military personnel deserve top-notch customer service when it comes to their finances. The best VA refinance lenders understand this and prioritize providing exceptional support to their clients throughout the entire refinancing process.

How to Choose the Best VA Refinance Lenders

Now that we’ve covered the benefits of selecting top VA refinance lenders, here are some tips for finding the right one for your needs:

- Research and compare lenders: Take the time to research and compare different VA refinance lenders. Look at their interest rates, fees, customer reviews, and any special programs they offer.

- Check for VA approval: Make sure the lender you choose is approved by the Department of Veterans Affairs (VA) to offer VA loans. This ensures that they are knowledgeable and experienced in handling these types of loans.

- Ask for recommendations: Reach out to fellow veterans or military personnel who have recently refinanced and ask for their recommended lenders. Personal experiences can be incredibly valuable in making your decision.

Benefits of VA Refinance Lenders for Military and Veteran Homeowners

In addition to the benefits mentioned above, there are some other key ways that choosing the best VA refinance lenders can positively impact military and veteran homeowners:

- More financial stability: A lower interest rate can result in significant monthly savings, providing more stability and flexibility in your budget.

- Consolidation of debt: If you have additional high-interest debt, refinancing your VA loan can allow you to consolidate it with your mortgage and potentially save on interest payments.

- Improved credit score: By making lower mortgage payments and consolidating debt, you may see an improvement in your credit score. This can make it easier to qualify for other loans or lines of credit in the future.

Access to Lower Interest Rates

One of the foremost benefits of refinancing through a VA-approved lender is access to lower interest rates. For veterans and military personnel, this can mean significant savings over the life of the loan. The best VA refinance lenders understand the sacrifices made by military families and strive to provide competitive rates that reflect their appreciation for this service.

Refinancing Up to 100% of Your Home’s Value

Unlike many conventional refinancing options that require borrowers to have substantial equity in their home, VA refinance loans often allow you to refinance up to 100% of your home’s value. This benefit is invaluable for those seeking to capitalize on their home’s equity without the burden of high out-of-pocket costs. The top VA refinance lenders make this process seamless, offering streamlined applications and guidance to ensure homeowners maximize their benefits.

Streamlined Processes for Military and Veterans

Understanding the unique financial situations of military and veteran homeowners is where the best VA refinance lenders truly shine. They offer streamlined processes designed specifically for VA loans, simplifying what can often be a complex and daunting task. From the initial application to closing, these lenders provide support and clarity, ensuring borrowers are well-informed and comfortable throughout the process.

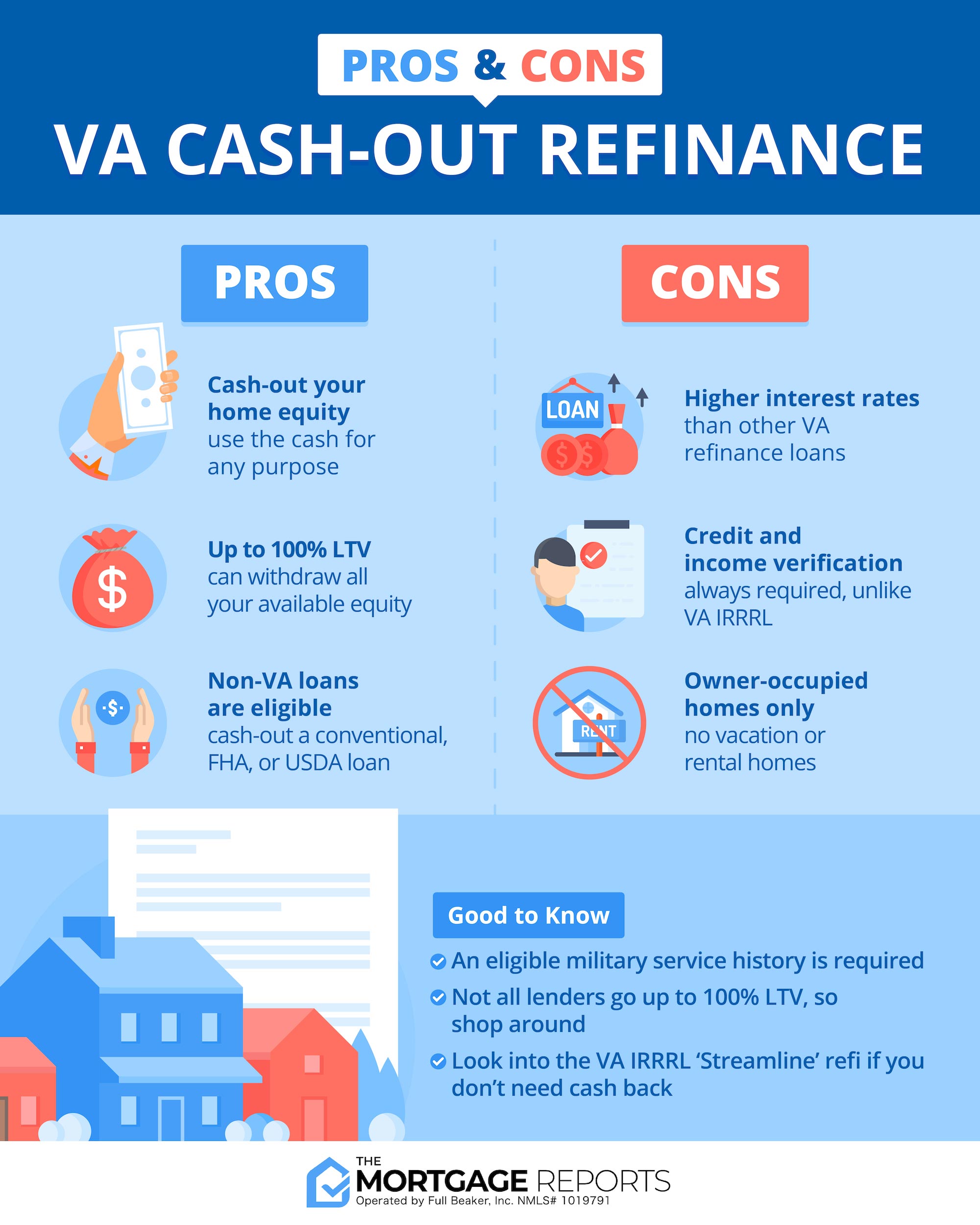

Benefits of Cash-Out Refinancing for Veterans

In addition to the traditional VA refinance option, veterans and military personnel may also consider a cash-out refinance. This type of refinancing allows borrowers to take out a new home loan for more than their current mortgage balance, pocketing the difference in cash. Some benefits of this option include:

- Access to additional funds: Cash-out refinancing can provide much-needed funds for large expenses such as home improvements, education, or debt consolidation.

- Lower interest rates: By refinancing at a lower interest rate, borrowers may see significant savings in the long run by paying less interest on their loan.

- Potential tax deductions: Depending on how the cash from a refinance is used, some homeowners may be able to deduct the interest on their taxes, resulting in potential savings.

In conclusion, choosing the best VA refinance lender is crucial for military and veteran homeowners looking to take advantage of their VA loan benefits. These lenders offer competitive rates, streamlined processes, and excellent customer service that caters specifically to the unique needs of those who have served our country. By understanding the benefits and tips for selecting a top VA refinance lender, borrowers can make an informed decision and potentially save thousands of dollars in the long run. So if you are a veteran or military personnel considering refinancing your VA loan, be sure to do your research and choose a lender that truly has your best interests at heart. Your financial stability and future could depend on it.

Experienced Support Tailored to You

Perhaps the most critical aspect of choosing the best VA refinance lender is the level of personalized support provided. These lenders have extensive experience with VA loans and understand the nuances that come with military service. They stand ready to offer tailored advice and solutions, ensuring that your refinance not just meets your financial goals but also honors your service and sacrifice.

Choosing Your Lender

When searching for the best VA refinance lenders, it’s important to consider not just the rates and terms offered but also the quality of service and support. Look for lenders with strong reputations among military and veteran communities, flexible refinancing options, and a commitment to providing detailed guidance throughout the refinancing process. By taking the time to select the right VA refinance lender, you can potentially save money and achieve your financial goals while also supporting a company that values and supports our nation’s heroes. So don’t hesitate to reach out for recommendations, do thorough research and choose a lender that will provide you with the best possible experience as a military or veteran homeowner. With the right VA refinance lender by your side, you can confidently move forward and reap the benefits of refinancing. So take advantage of your VA loan benefits and choose a lender that will help you achieve financial stability and success. Thank you for your service! Keep on thriving. Happy refinancing!

Tips for Choosing the Best VA Refinance Lender

Choosing the right VA refinance lender is a decision that can significantly impact your financial future. Here are some critical tips to help you select a lender that best suits your needs:

- Research and Compare: Start by researching various lenders to understand their offers, interest rates, and terms. Comparing these elements will help you identify which lender provides the best deal for your situation.

- Read Reviews and Testimonials: Look for reviews and testimonials from other veterans and military personnel who have refinanced with the lenders you are considering. These insights can give you an idea of the lender’s reputation and the quality of service they provide.

- Check for Licenses and Accreditation: Ensure that the lenders you are considering are licensed to operate in your state and have accreditation. This step verifies their legitimacy and commitment to adhering to regulatory standards.

- Understand the Fees: Be clear about all the fees involved in refinancing your VA loan. Some lenders may offer lower interest rates but charge higher fees, which could negate the savings you’re seeking.

- Customer Service: Choose a lender that is known for excellent customer service and support. The ability to easily contact your lender and receive prompt, helpful responses to your inquiries is crucial during the refinancing process.

- Ask About the Application and Approval Process: Understanding the lender’s application and approval process can help you determine if their timeline aligns with your refinancing goals. Some lenders offer a more streamlined process, which could be beneficial if you’re looking to refinance quickly.

- Consult with Financial Advisors: If possible, consult with a financial advisor or housing counselor who can provide personalized advice based on your financial situation and goals. Their expertise can guide you in selecting the right lender.

By following these tips, you can more confidently choose a VA refinance lender that will help you achieve your financial objectives while honoring your service.

Some reputable VA refinance lenders in US

After considering the above tips for selecting the ideal VA refinance lender, it’s beneficial to have a starting point with some reputable examples. Among the well-regarded VA refinance lenders are:

- Veterans United Home Loans: Known for offering specialized services tailored to veterans and active military members, Veterans United has a strong reputation for customer satisfaction and comprehensive VA loan options.

- Navy Federal Credit Union: Exclusive to military members, veterans, and their families, Navy Federal Credit Union provides competitive rates and terms, coupled with exceptional member service.

- USAA: With a long history of serving military members and their families, USAA offers a variety of financial services, including VA refinancing, and is noted for its customer service and financial advice.

- Quicken Loans by Rocket Mortgage: Recognized for its technology-driven approach, Quicken Loans offers a streamlined refinancing process that can be appealing for those seeking efficiency alongside competitive interest rates.

- PenFed Credit Union: Offering a range of VA loan refinancing options, PenFed Credit Union is known for its favorable terms and dedicated support to the military and veteran communities.

Each of these lenders brings something unique to the table, whether it’s a focus on technology, exceptional customer service, or specialized military knowledge. When choosing a VA refinance lender, it’s crucial to consider what aspects are most important to you and how each lender aligns with those priorities.

Conclusion

Refinancing your home through a VA loan offers a range of benefits designed to honor the service of military members and veterans. By choosing the best VA refinance lenders, you can access lower interest rates, achieve significant financial savings, and receive the support you deserve. Whether you’re looking to lower your monthly payments, cash out equity, or simply streamline your current VA loan, the right lender can make all the difference.

For military veterans and active duty personnel, the path to financial wellness begins with a partner who understands your unique needs and honors your service. Start your search for the best VA refinance lenders today, and take the next step towards a more secure and prosperous financial future.